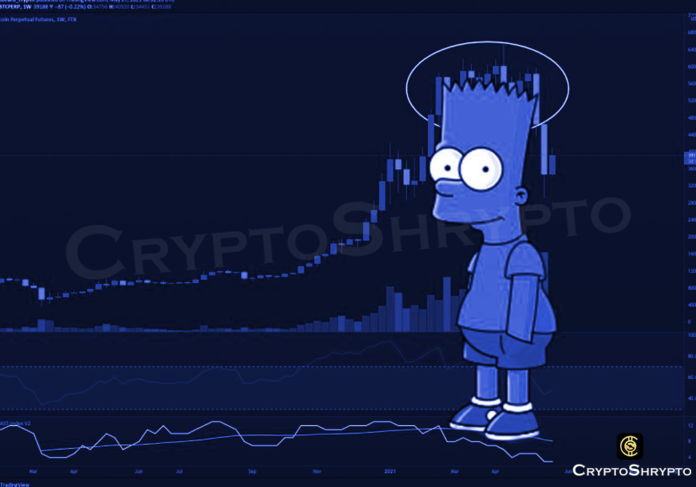

The “Bart Simpson” pricing pattern, which resembles the cartoon character’s haircut, returned to the bitcoin market early on March 15, when the cryptocurrency experienced a fast surge and fall in a lightly traded market.

According to statistics, Bitcoin soared from $39,120 to $41,700 in 30 minutes at 02:15 UTC, only to fall back to $39,000 by 03:00 UTC. The unexpected spike might have been caused by stop orders on short transactions that ran into heavier selling pressure.

Alex Kuptsikevich, senior market analyst at FXPro, stated that the rate increased sharply from $39,200 to $41,700, followed by an almost equally swift drop to below $39,000. Stop orders were activated in the morning’s low-liquidity market, but it’s evident that the selling pressure is still enormous. In reality, since February 10, the gains in the bitcoin rate have gotten shorter and shorter, ending at progressively lower levels, he added. Multiple bull fails above $42,000 have lately occurred in the cryptocurrency. The latest from today’s Asian session was most likely the consequence of market makers’ actions—companies that quote both a purchase and a sell price on a tradable item held in inventory to satisfy the market.

Laurent Kssis, director of CEC Capital and a crypto exchange-traded fund (ETF) specialist, emphasised that in slow and negative markets, market makers have a tendency to systematically short the market, i.e., they are outright selling the exchange and/or selling the futures. If a rise like we’ve seen this morning occurs, there’s a chance the exchanges will want greater margin and the market makers will be liquidated. To avoid this, market makers lower the market, she remarked.

As demonstrated by a downward trend in daily trading volumes on major exchanges, trade activity has slowed in recent weeks. As a result, relatively small transaction quantities can have a significant influence on the market.