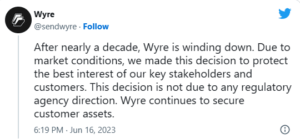

Wyre, a San Francisco-based cryptocurrency payments company, is shutting down after operating for over ten years. The company claims that its decision has nothing to do with the aggressive “regulatory authority stance” in the United States and the decision is driven by the monetary difficulties caused by the bear market.

The company wrote in a blog post on June 16 that it has made the tough choice to shut down in order to ” safeguard the highest possible interest of its main stakeholders and users.”

Wyre keeps safeguarding consumer assets. You can still withdraw whatever assets you have on the Wyre platform through the dashboard until Friday, July 14. After that, we will have a different procedure to reclaim any assets that are still on the platform, according to the company.

Additionally, the Wyre company hinted that the company’s assets are currently up for sale, saying: “If you’re interested in purchasing Wyre’s or its subsidiaries’ assets, please do reach out to 88 Partners.”

Since one-click checkout giant Bolt scrapped its goal to buy Wyre for $1.5 billion in September 2022, the business is said to have circled the drain.

Trouble first surfaced on January 4, 2023, when Juno, a supplier of fiat-to-crypto on-ramp solutions, urged its users to remove their crypto assets out of the platform’s servers and take self-custody because of the claimed “uncertainty” surrounding its custodial operator Wyre.

The next day, MetaMask discontinued support for Wyre’s cryptocurrency payment services due to the same problem.

A few days later, Wyre set a 90% withdrawal cap for every customer, but immediately lifted it on January 13 after receiving funding from an unknown “strategic partner,” raising hope that the company was recovering. Wyre reportedly also fired 75 people in January.

Wyre joins a long line of cryptocurrency and blockchain businesses and initiatives that have crumbled under the weight of a prolonged bear market.

Unbanked, a crypto financial technology company, HotBit, a cryptocurrency exchange; Terressa, a trading platform for nonfungible tokens; BottlePay, a Lightning Network payments platform and TradeBlock, a platform for institutional trading from Digital Currency Group, all closed down during May alone.