The worldwide business dynamics have shifted as a result of COVID-19. Customers are embracing new, digital forms of money, resulting in the crypto industry’s rise, prompting businesses to accelerate their digital transitions. On June 8, Deloitte, in collaboration with Paypal, released the “Merchants Getting Ready For Crypto” report. The report highlights the ideas and perceptions of US retailers towards the adoption of digital currency payments and the impact that crypto may have in the future. 75% of retailers plan to accept cryptocurrency or stablecoin payments within the next 24 months.

The survey for the report took place between December 3 and December 16, 2021; it interviewed 2,000 senior executives from retail companies across the United States. The report reaffirmed the intensity and direction of the trend toward widespread use of digital currency payment solutions by US retail businesses.

Retailers perceive economic and corporate benefits from accepting digital currency payments. 83% of merchants expect that consumers’ interest in digital currencies for payments will significantly increase over the next 12 months. Merchants are ready to accept digital currency payments as they recognise that the market is evolving rapidly and aim to accommodate customer demands. They intend to gain value from their digital currency adoption in three ways:

Retailers are increasingly positive about the use of digital currency as a form of payment, and many see it as a commercial need. 85% of surveyed retailers believe that digital currency payments will be ubiquitous among their industry’s suppliers in the next 5 years.

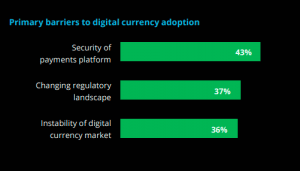

Multiple barriers to crypto payment adoption were highlighted by respondents, with customer security of payment systems leading the list (43%), followed by the shifting regulatory landscape (37%), and the volatility of the digital currency market (36%).

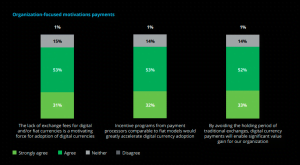

Businesses are mostly cooperating with third-party payment processors to enable digital currency payments, and there appears to be little link between their motives for adoption. Merchants are most interested in incentive programmes based on transaction volume and/or value, new customer promotions, and no transaction expenses, which are the top three motivators.

The positive response from the retailers suggests that the usage of digital currencies for routine, everyday purchases will increase in the future. The trend is expected to continue as technology improves and merchants’ confidence is boosted because of the good response from the customers.