Hester Peirce, commissioner at the U.S. SEC has urged that digital currency regulations in the country should be “reserved” rather than treating the technology’s uses as purely financial assets.

On June 29, ‘Crypto Mom’ Commissioner Hester Peirce made a virtual appearance at Australian Blockchain Week. When questioned how she would govern cryptocurrency, she responded:

The legal framework you have shouldn’t automatically assume that everything is a financial asset, in my opinion, the commissioner said.”

Peirce argued that although cryptocurrency is often thought of in “very financial terms,” it also has other applications, such as enabling social interaction without the need for a central authority.

The commissioner further added, “That’s useful from a monetary standpoint, but it’s also helpful for creating a social networking platform or anything else.”

According to Peirce, any regulatory structure should be “reserved” but yet having “sufficient clarity that people feel like they can try things.”

There is merit in avoiding establishing a framework that is too rigid and fails to take into account the novel applications of cryptocurrency and blockchain.

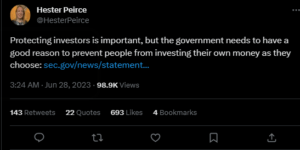

The commissioner reportedly jibes over the SEC’s present strategy, which Peirce and others have criticised, saying that rules “can’t be put aside and then, all at once [regulators] arrive five years later with a number of regulatory actions.”

When asked about her support for cryptocurrencies, Peirce responded that she feels the SEC “can do better” and that if she isn’t allowed to talk freely, “I have no idea why I’m in that post.”

Crypto gives the SEC a chance to reconsider how we handle innovation. I genuinely believe that our strategy has been inappropriate, she declared.

Peirce recommended the crypto business to practise self-monitoring and pay close attention to competitor risks, conflicts of interest and leverage in an allusion to FTX’s demise and the subsequent accusations of misbehaviour.

“Those are things that you do not require a government agency to tell you to do, but I think that legal authorities have a role in that.”