On August 3, Microstrategy CEO Michael Saylor expressed via tweet that MicroStrategy would still be able to provide something that spot Bitcoin ETFs cannot, when asked on how an authorised spot Bitcoin ETF may affect the products offered by his company.

Additionally, he has confirmed that his company intends to keep adding Bitcoin to its portfolio, possibly with the money from a proposed $750 million share offering.

MicroStrategy co-founder Michael Saylor is confident that his company will continue to offer clients a compelling method to invest in Bitcoin, irrespective of any upcoming approvals for exchange-traded funds.

Saylor stated that even with the arrival of spot ETFs, MicroStrategy will continue to be “differentiated as a specific Bitcoin operating approach” during the August 1 earnings call.

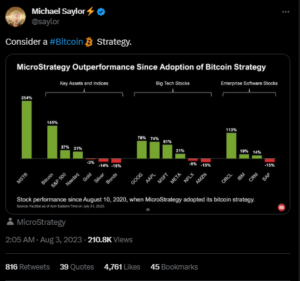

He added that his business uses leveraged investments to produce yields that are then distributed to shareholders, noting that the price of bitcoin has increased by 145% since the firm began buying strategy in August 2020.

We consider it good for the whole ecosystem because we can access leverage as a running company, something an ETF couldn’t do.

Saylor, on the other hand, asserted that spot Bitcoin ETFs will enable major sovereigns and hedge funds to enter the market with billions of dollars.

During the earnings call, he stated, “Spot ETFs will benefit another group of market participants in a synergistic manner to grow the whole asset class.”

As per Fintel, the company has over 470 institutional shareholders and a market value of $5.3 billion. On August 2, analysts raised the probability of a spot Bitcoin ETF getting approval in the US to 65%.

When questioned how much their current holdings of 152,800 BTC will expand in the upcoming quarters, Saylor responded that the intention is to “accumulate as much Bitcoin as we can.”

According to a recent SEC filing, he also revealed that the company wants to sell up to 750 million dollars’ worth of class A common stock and he further stated that the primary purpose of the profits “generally is just to buy Bitcoin.”