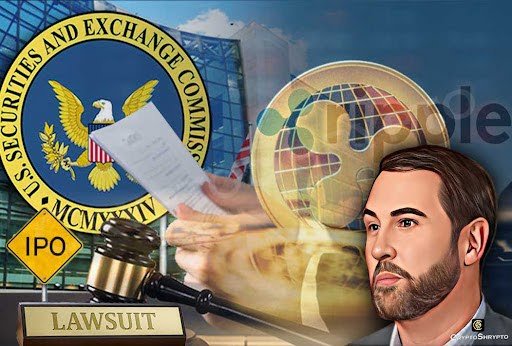

Ripple CEO Brad Garlinghouse told CNBC that when the Securities and Exchange Commission (SEC) lawsuit is resolved, the company would consider an initial public offering (IPO).

Ripple’s tokens (XRP), the market’s sixth biggest cryptocurrency, are used to make cross-border payments. The firm converts currency to XRP to reduce transaction costs as they enhance speed, and then converts XRP back to fiat.

The SEC accused Ripple CEO and Ripple executive chairman Chris Larsen of engaging in unlawful securities offers during XRP sales. The SEC lawsuit has been ongoing for 15 months, but Ripple has defended itself, claiming that the coin should not be treated as a security, but rather as a classification that would subject it to stricter regulations.

However, the company believes that all of this will be completed by the end of this year, allowing them to focus on the public listing.

Garlinghouse told CNBC at the World Economic Forum in DAVOS, Switzerland, that “I believe we want to achieve confidence and clarity in the United States with the U.S. SEC.” I’m hoping that the SEC won’t hold down the process any more than they already have… But, you know, we are absolutely at a size where that is a possibility. And we’ll look into that when we finish with the SEC.”

His statement occurred in the middle of the crypto market crash, which has caused billions of dollars in the crypto market, as well as crypto-related equities, to lose value. Furthermore, XRP has fallen 41.9% in the last 30 days, with Coinbase shares down 75% this year and Robinhood stocks falling almost 50%.