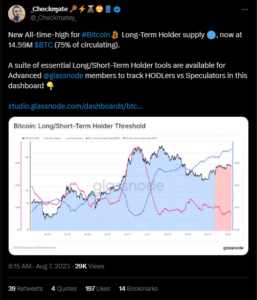

The latest data from blockchain analytics company Glassnode reveals that the most avid supporters of Bitcoin, referred to as long-term holders in the industry, currently have more Bitcoin (BTC) than ever before.

The data shows that the so-called long-term holding supply currently equals 14.599 million BTC or 75% of the total amount of Bitcoins in circulation.

According to Glassnode, the greatest value ever recorded for this measure is 14.599 million BTC held by long-term holders. In the past week alone, the amount has climbed by 43,949 BTC, or around $1.3 billion.

Long-term holders are wallet addresses that have kept their coins for 155 days or longer; as a result, it is assumed that they are less inclined to spend or sell them even if the price falls.

On August 7, Glassnode’s lead on-chain analyst, Checkmate, posted a graph of the record high on X (Twitter) platform.

Bitcoin’s volatility has plummeted to multi-year lows even though there are now more long-term holders of Bitcoin than ever before.

The Week Onchain Newsletter from Glassnode reports that Bitcoin’s 1-year volatility is currently at its lowest level since December 2016, and the 30-day price range is contained in a small band that is only 9.8% broad.

In the paper, Glassnode stated that “periods of consolidation and price compression at this magnitude are exceptionally uncommon events for Bitcoin.”

In a tweet, it continued, “It suggests that Bitcoin is no longer notoriously volatile… or volatility could be mispriced.” Options markets now reflect the extraordinarily low volatility.

Glassnode analyst Checkmate commented on the discovery that volatility has reached record lows in a post on X, claiming that this current time of low volatility “synchronises with the post-bear-market hangover times.”