One of the early cryptocurrency promoters, Blockstream CEO Adam Back, is very optimistic that Bitcoin will touch an all-time high of over $100,000 before Bitcoin is halved in 2024 and is ready to stake $1 million in it.

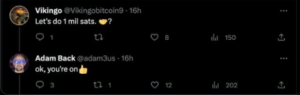

On August 7, during a chat on X (formerly known as Twitter), Back and anonymous X user @Vikingobbitcoin decided on a bet that Bitcoin will hit $100,000 by March 31, 2024. Vinkingo stated that it probably won’t occur until 2025.

Back predicts that the price will most likely touch a new all-time high earlier than the actual date of the halving period, which is presently scheduled for April 26. As a result, the betting date falls about a month before the halving.

Notably, huge sums have previously been staked on predictions of sharp rises in Bitcoin’s price, such as Balaji Srinivasan’s $1 million 90-day Bitcoin wager in March.

Additionally, Adam has previously expressed optimism about Bitcoin, stating in February that it might hit $10 million on its sixth halving in 2032.

This time, Adam is actually investing his own money to support his most recent statement. Unfortunately, instead of dollars, it’s a million satoshis. That just costs $290 at the present price (or more than $1,000 if Back’s forecast comes true).

The smallest divisional unit of Bitcoin is a satoshi, or “sat” for short. There are 100 million sats in one bitcoin (BTC). Given that Back’s net worth is thought to be anywhere between $50 and $300 million, it is therefore a relatively minor gamble for him.

Samson Mow, the CEO of Jan3 and a fellow Bitcoiner, responded to Back’s original article by stating that he too believes that Bitcoin will reach a new all-time high, but “pre halving, not post.”

Despite the little gamble, it has received some sarcastic comments; nonetheless, it still indicates an increasing bullish tendency among market pundits and analysts on the price of Bitcoin.

Charles Edwards, the founder of Capriole Investments, stated in an interview on February 24 that the forthcoming halving will make Bitcoin the “hardest asset in the world” and that the market seems to be in the beginning phases of a new bull cycle.