Binance.US, has unveiled an innovative collaboration with crypto payment enterprise MoonPay, after transitioning to a crypto-exclusive stance two months ago. This strategic partnership aims to empower users to acquire the USD-pegged stablecoin Tether (USDT) for utilisation on the platform.

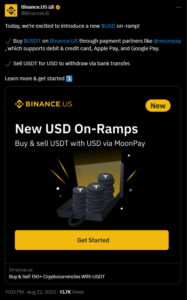

In an announcement dated August 22, the cryptocurrency exchange introduced USDT as the fresh “base asset” for all transactions. Leveraging its alliance with MoonPay, Binance.US introduces a gateway for users to engage in transactions using US dollars.

This collaboration emerges in response to the hurdles Binance.US encountered with its banking associates, which led to the suspension of fiat deposits on the exchange since June 9.

The exchange attributed this disruption to the “aggressive and intimidating” tactics employed by the Securities and Exchange Commission (SEC), which had filed a lawsuit against the exchange and its affiliates four days prior.

As part of this pioneering collaboration, individuals seeking to fund their Binance.US accounts can now seamlessly convert dollars into USDT. Subsequently, this USDT can be utilised for the acquisition of other cryptocurrencies accessible on the platform.

Although direct bank deposits remain temporarily unavailable on Binance.US, this strategic partnership offers users an alternate route for funding through debit and credit cards, in addition to Apple Pay and Google Pay options.

On June 23, the exchange confronted challenges with USD-denominated withdrawals, although it managed to restore functionality on a provisional basis. The exchange cautioned that this service would soon be discontinued.

Before the SEC lawsuit disrupted Binance.US and its affiliate operations, the exchange facilitated the trading of popular cryptocurrencies via direct USD deposits and withdrawals.

In March, a series of cryptocurrency exchanges and service providers faced the loss of their banking partnerships amidst a broader banking crisis. This period witnessed the collapse of several crypto-friendly banks including Silicon Valley Investment Bank, Silvergate and Signature Bank, all within a brief span of a few weeks.