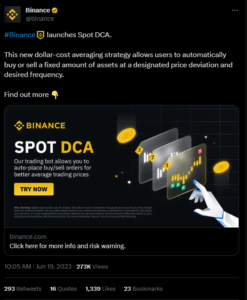

On June 19, the Binance CEO, Changpeng Zhao, introduced Spot DCA (Dollar-Cost Averaging) via twitter, on the Binance Spot platform, despite facing continued regulatory difficulties including a recent lawsuit brought by the U.S. Securities and Exchange Commission (SEC).

During this current instability in the market, the biggest cryptocurrency exchange in the world seeks to mitigate the effects of market fluctuation and protect its customers.

In its most recent blog, Binance introduced the Spot DCA in an effort to improve customer trading experiences and decrease the effects of market volatility.

Notingly, this new ground-breaking technology could help consumers to automate cryptocurrency purchases and sales at set prices and frequency, hence minimising the impact of market volatility.

Dollar-cost averaging is a successful investment method for lowering risk and handling market volatility. Regardless of the asset’s current market price, users may automate their trades using this functionality in the field of cryptocurrencies.

However, customers doing Spot DCA can benefit from average pricing over time, which lessens the impact of short-term price volatility.

Customers of Spot DCA can create trading bots that autonomously carry out buy or sell orders in compliance with predetermined criteria.

Apart from this, Users are able to remain in profit even after market downturns, because DCA helps in building up assets at lower costs while also safeguarding profits when prices rise over their targeted take-profit percentage.

Binance has been under scrutiny from regulators and the SEC has most recently accused the company. In the lawsuit, Binance is accused of running an unlicensed exchange, offering unregistered assets for sale and mixing client money with its own.

Additionally, the SEC claimed that Binance, Binance.US and its creator had enriched themselves with the customers funds.

The introduction of Spot DCA reflects Binance’s dedication to its consumers by giving them cutting-edge solutions to deal with market volatility.