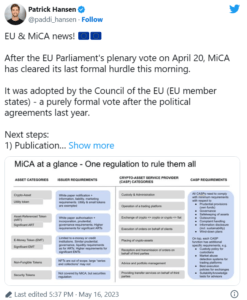

The EU nations approved the world’s first complete set of regulations to govern digital currencies, known as the Markets in Crypto-Assets (MiCA) legislation, on May 16.

This move puts more pressure on countries like the United Kingdom and the United States to go with the same pattern.

The laws, which are to go into effect in 2024, will force enterprises in the 27-country bloc to get a permit in order to create, exchange, and preserve crypto assets, tokenized assets and stablecoins.

The MiCA rules are intended to promote openness and create a complete framework for guarantors and service providers, incorporating consistency with hostile to tax evasion rules.

The administrative system means to safeguard financial investors, maintain financial stability, while encouraging advancement and the appealing quantities of the crypto industry.

Elisabeth Svantesson, Sweden finance minister, which holds the EU administration, states, “Late occasions have affirmed the urgent requirement for forcing rules which will better safeguard Europeans who have put monies into these digital currencies, and forestall the abuse of the crypto business for the reasons for tax evasion and funding of illegal intimidation.”

The legislation’s scope encompasses a wide range of virtual assets, including utility coins, asset-referenced tokens, and stablecoins.

It also covers products like trading platforms and wallets, which store cryptocurrency. Additionally, the guidelines target bitcoin market misuse, insider trading, and misleading behaviour.

Final Steps for MiCA Implementation

The last stage for MiCA to become regulation in EU, requires it to be published in the official Journal of the European Union. MiCA will happen in the span of a year, meaning the guidelines will become regulation halfway through 2024.

Both bitcoin service providers and supporters have praised the law for creating a unified market ecosystem across Europe in terms of regulatory standards and operational practises.

Hester Peirce states that a commissioner at the U.S. derivatives regulator CFTC, said that nations like the U.S. who do not yet have full crypto legislation are “wandering in the desert a bit,” showing the significance of the EU’s establishing move.